Streamline how you reimburse employees who use personal vehicles for work, maintain compliance, and ensure they get paid fairly.

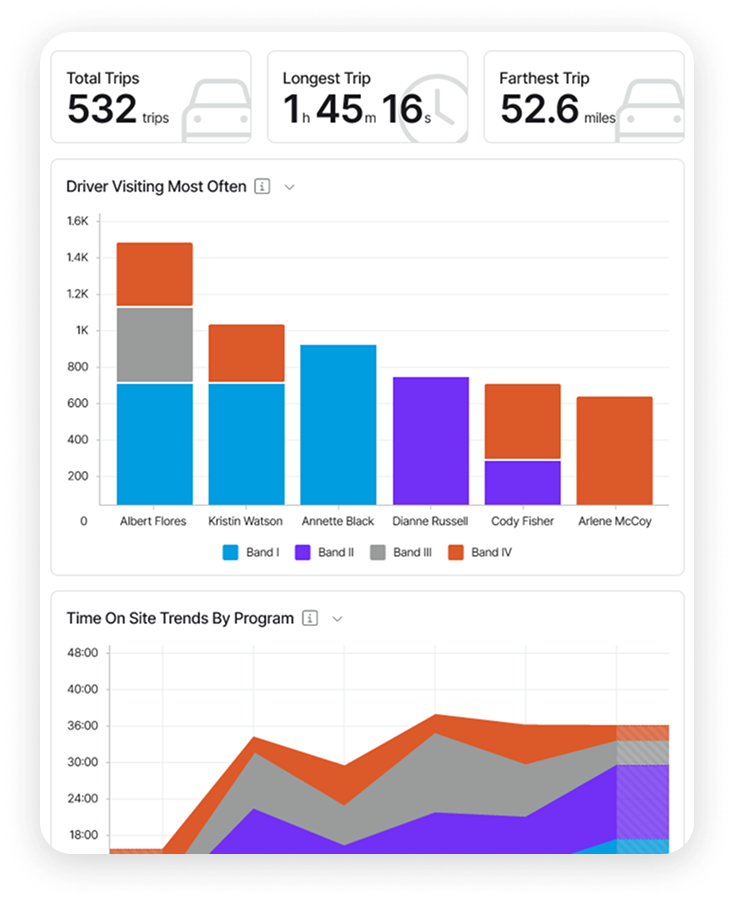

Built for accuracy, simplicity, and speed to save time for everyone. Fully automated, tax-advantaged reimbursements for your employees who use their own vehicles for work.

Best for

High-mileage or multi-region teams that need the most accurate, tax-advantaged reimbursement.

What it does

Delivers localized reimbursements that reflect the true fixed and variable costs of owning and operating a vehicle.

*Cities and states have different rates because the true cost of operating a vehicle varies significantly by location due to regional differences in gas prices, insurance, taxes, license fees, maintenance costs, and local cost-of-living rates.

Best for

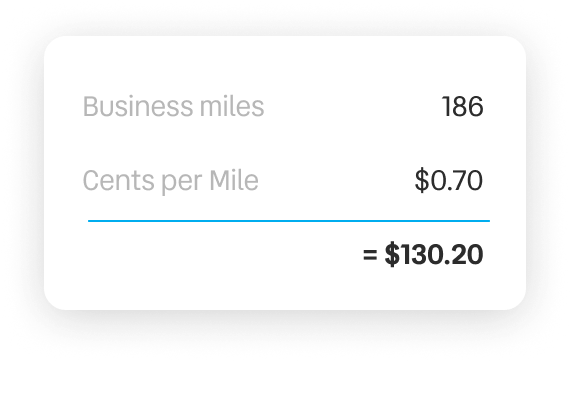

Companies looking to reimburse mileage at the same rate for every driver.

What it does

Pays employees a per-mile rate — typically the IRS standard mileage rate — for compliant, tax-free reimbursement.

Best for

Organizations that want fixed monthly payments for employees with a tax-efficient approach.

What it does

Provides a fixed monthly allowance paired with mileage tracking for maximum tax advantage.

No matter which program you choose, get strategic consulting, full implementation support, and best practices to maximize employee satisfaction.

Built from real customer scenarios, get clear, practical guidance to set up a compliant program — and ongoing support to keep it aligned as things change.

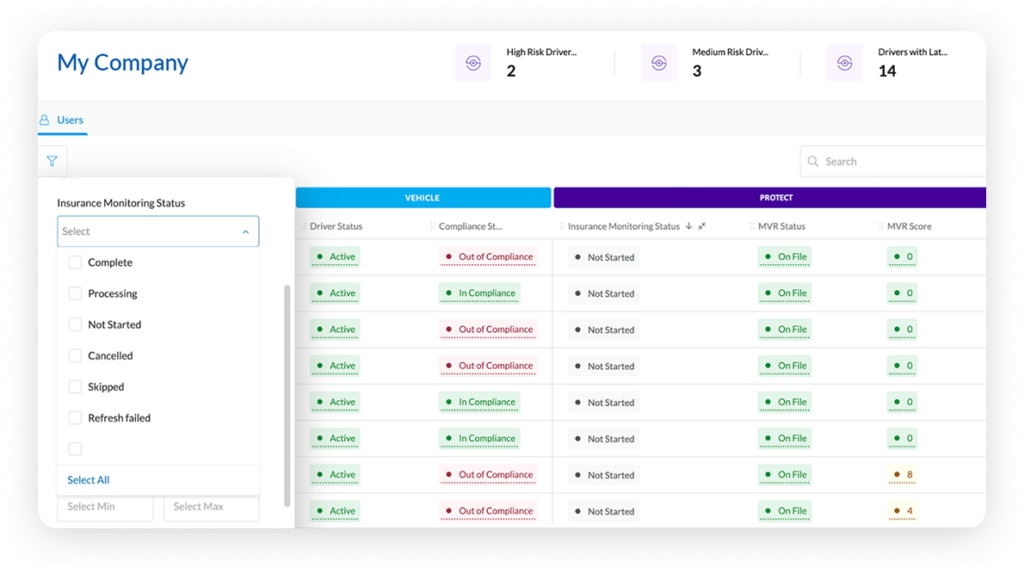

Integrated safety training and continuous monitoring don’t just check a compliance box – they actively reduce risk and reinforce safer driving across your workforce.

Since implementation, Motus has been using their advanced technology to seamlessly handle our automobile reimbursement program. Unlike with many vendors, their customer service team is also top-notch and easy to reach.”

Motus has greatly reduced the work of our staff to run and maintain operations with our sales force.”

Once our employees bought into it, they really like using it and the reimbursements. In turn, our organization has recognized significant cost savings while staying compliant with the IRS.”

Motus has made mileage tracking more efficient while saving administrative time and money. They’ve also made being IRS compliant very simple and efficient.”