For companies that rely on field teams (sales reps, service technicians, marketers, and medical staff) who drive to customers and job sites, the road is a workplace. And, when unsafe driving happens in that workplace, the costs can add up quickly.

Accidents lead to liability claims and weeks of lost productivity. Tickets and collision repairs drive up insurance premiums and erode employee reimbursement dollars. Commercial auto insurance premiums have risen for 25 straight quarters, and one accident can spike a company’s rates by nearly 45%.

The reality is clear: even when employees drive their own cars, unsafe driving is a business problem that puts budgets and reputations at risk.

What Unsafe Driving Looks Like for Field Teams

Unsafe driving isn’t limited to reckless behavior. For employees who spend hours on the road getting to customers and job sites, everyday risks are everywhere:

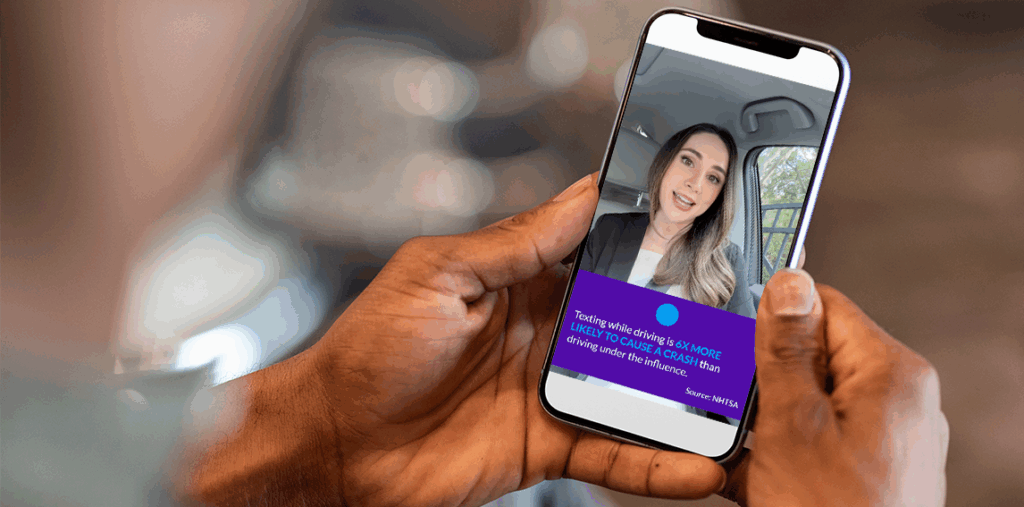

- Distracted driving: texting, calls, or checking apps between stops.

- Seasonal and environmental risks: winter roads, storms, or poor visibility.

- Fatigue: long hours behind the wheel and tight schedules.

- Routine but risky habits: rolling stops, speeding to appointments, or tailgating.

When multiplied across a large field workforce, these small risks create significant corporate liability and cost exposure.

Why Traditional Driver Training Misses the Mark

Some organizations already offer driver safety training. But, traditional corporate driver training programs often struggle to connect with field employes in a meaningful way. Long sessions can be difficult for busy teams to complete, and one-size-fits-all content doesn’t always reflect the specific challenges that drivers face on a daily basis.

The results can be limited knowledge retention and low adoption, which leaves companies with the same risks despite their investment.

In today’s mobile workplace, companies need training that is short, relevant, and built into their flow of work.

The Better Way: Road Smart from Motus

That’s why Motus is expanding its Motus Protect suite with Road Smart. Motus Protect has always been about helping organizations reduce risk and strengthen compliance; we integrate always-on MVR and insurance monitoring into the vehicle reimbursement workflow. Road Smart builds on that promise with driver safety training designed specifically for field employees who drive their own cars for work.

Here’s how Road Smart works:

- Quick, engaging lessons: Each course takes less than two minutes and focuses on one real-world risk at a time.

- Seamlessly integrated into Motus Reimburse: Training lives in the same app that employees already use to log and submit mileage. No extra tools or logins required.

- Built-in compliance: Companies can enable accountability controls that require drivers to complete lessons before submitting mileage, which ensures adoption and helps demonstrate due diligence.

It’s safety training that employees will actually complete because it’s convenient, accessible, and directly tied to the way that they already work.

Safer Drivers, Stronger Businesses

The impact goes beyond safety. With Road Smart, companies can:

- Reduce avoidable expenses: Help employees avoid tickets and repairs that raise insurance costs and erode reimbursement dollars.

- Limit risk exposure: Put better-prepared drivers on the road, demonstrate due diligence, and reduce liability claim risk.

- Improve adoption and retention: Offer training that fits into employees’ routines, which can boost engagement, compliance, and productivity.

It’s not just about avoiding costs. It’s about building a safer, more resilient workforce that can focus on serving customers.

“Auto insurance is the toughest P&C line for mid-market companies: essential yet economically strained by rising claims and volatility. It was a daily push to de-risk and improve driver safety. With Motus, we found a comprehensive solution that could be integrated with the reimbursement program that we already had in place. Road Smart’s in-app training, combined with insurance and MVR monitoring, builds proactive safety intercepts into the existing driver workflow. We can now demonstrate action to both our employees and to insurance companies, giving us confidence in how we manage risk proactively and intentionally. Safe driving is not just a slogan that we repeat to our employees once a month; it’s our way of doing business every day. Safety matters, and Motus helps make it happen!” said Malcolm O’Neal, CHRO of Renovo Home Partners.

The Future of the Holistic Vehicle Reimbursement Solution

Road Smart represents the next step in modern vehicle reimbursement programs, which include a complete risk mitigation solution with integrated MVR and insurance monitoring alongside driver safety training. Safe driving isn’t just a personal responsibility; it’s a business imperative. By embedding safety training into reimbursement workflows, companies can protect their people, safeguard their budgets, and demonstrate accountability in a way that traditional training has never achieved.

The road ahead is clear: safer employees, stronger companies, smarter vehicle programs.

Want to see how Road Smart can help your organization reduce risk and costs? Check out Road Smart today!