Every vehicle program comes with trade-offs. Fleet, allowance, and cents-per-mile programs each have their place, but many organizations are discovering hidden costs, compliance gaps, and limitations that impact their employees. The challenge is knowing when your current program is holding you back.

This guide provides a framework to evaluate whether your current program is truly sustainable or whether it’s time to adopt a more tailored approach that reduces costs, minimizes risk, and keeps your workforce productive.

Evaluating Your Company Fleet Program: Signs You May Be Ready for Change

Fleet programs have long been a go-to option, but they often mask significant financial and operational risks. Rising costs, rigid contracts, and employee dissatisfaction make it harder for companies to justify keeping a fleet model in place.

Challenges Companies Face with Fleet

Full fleet transitions can be complex, but middle-ground solutions exist. Moving an entire fleet to a new model can be daunting, especially when operational and financial variables differ across locations and employees. Adopting a one-size-fits-all strategy often results in missed opportunities to optimize spend or reduce risk, particularly for lower-mileage drivers who could be better served by alternative solutions.

Lack of visibility into true total cost of ownership. Unplanned costs from accident claims, repairs, incident-related issues, and fuel card misuse disrupt budgets and make it difficult to control total cost of ownership. Additionally, rising insurance premiums and unpredictable company-wide rate increases are placing added strain on fleet budgets. This volatility makes it challenging to optimize spend and minimize risk.

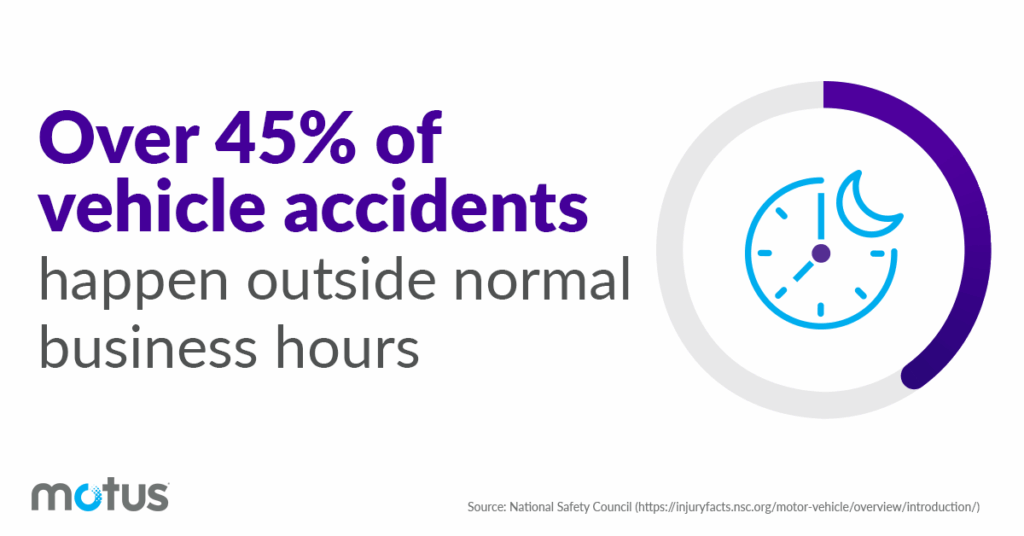

Idle vehicles, misuse, and off-hours accidents drive up costs. Company cars are often used outside of work, creating additional exposure and unbudgeted expenses.

Leasing contracts that lock you into rigid terms. Fixed agreements limit your ability to adapt when business or economic conditions change.

Limited employee choice leads to dissatisfaction. Standard-issue vehicles rarely meet everyone’s needs, impacting morale and retention.

What to Look for in a Modern Approach

A modern approach gives you more control and flexibility over your passenger fleet vehicles. Instead of being locked into a rigid model, you can right-size your program for better efficiency and higher employee satisfaction.

Centralized visibility with consistent and predictable costs. A single source of truth eliminates hidden fees and simplifies forecasting.

Flexibility to scale programs up or down. Adjust your program quickly as your workforce or market dynamics shift.

Employee freedom to choose vehicles suited to their lifestyle and job. Empowering employees with choice creates higher satisfaction and retention.

If your fleet program is weighing you down with high costs and hidden liability, vehicle reimbursement programs, such as a FAVR program that calculates reimbursement rates based on both fixed and variable expenses for drivers, offers a smarter path forward. By right-sizing costs, reducing exposure, and giving employees more choice, you can modernize your program without sacrificing control.

Evaluating Your Allowance Program: Signs You May Be Ready for Change

Car allowances may seem simple, but they create hidden tax burdens and fairness issues that frustrate both companies and employees. Without compliance safeguards, allowance programs can expose businesses to costly risk.

Challenges Companies Face

Tax waste that consumes budget intended for employees. Flat allowances are typically taxable, meaning a large portion of spend never reaches your team. However, tax-advantaged reimbursement models

Equal payments regardless of mileage create inequity. High-mileage drivers often feel underpaid, while low-mileage employees may be overpaid.

Potential gaps in driver risk oversight: Flat allowance programs often do not include formal processes for monitoring driver insurance coverage or motor vehicle records (MVRs). Without these structures in place, organizations may be at greater risk for liability, though this can vary depending on how the program is managed.

Implementing a Formal Vehicle Reimbursement Program

A modern approach means putting a formal vehicle reimbursement program in place—one that provides structure, visibility, and flexibility without forcing an immediate leap to complex models. For many organizations, the most effective next step is to enhance their existing allowance program by adding substantiation and compliance controls. This transition offers meaningful improvements in both cost management and risk mitigation, while preserving the ability to flex the program as business needs change.

At Motus, our approach centers on flexibility and supporting your organization’s unique requirements. Our team of experts can review your mileage trends to help you decide if another reimbursement model could meet your needs better—such as FAVR—that could offer additional value. For many organizations, Moving to FAVR can unlock up to 40% savings while improving compliance and employee trust.

Evaluating Basic Expense Reports for Mileage Reimbursement

Reimbursing employees who drive using a cents-per-mile rate and basic expense reports may seem simple, but without the right structure they are vulnerable to fraud, compliance gaps, and employee frustration. Transitioning to a vehicle reimbursement program introduces the controls and visibility organizations need to optimize spend and minimize risk.

Challenges Companies Face

Mileage fraud and padding: When employees self-report mileage, it’s easy to round up trips or exaggerate distances, inflating costs by up to 30%.

Lack of controls in expense systems: Standard T&E platforms often do not have guardrails for mileage, allowing duplicate entries or unsubstantiated claims.

Manual mileage tracking: Spreadsheets and handwritten logs are error-prone, time-consuming, and frustrating for employees who just want to focus on their jobs.

Limited visibility into field activity: Without accurate mileage data, managers can’t see where employees are driving, making it difficult to optimize coverage or align activity with business priorities.

What to Look for in a Modern Approach

Automated GPS capture for accurate, non-editable mileage records. Technology ensures defensible data while eliminating employee guesswork.

Centralized visibility into driver activity and spend. Real-time insights help align field operations with business goals.

Automated workflows to reduce friction for employees. Easy-to-use apps streamline submissions and keep employees focused on their work.

Equitable, IRS-compliant reimbursements tailored to actual driving. Data-driven rates eliminate inequities.

Reimbursing without the tolls and controls of a GPS-based vehicle reimbursement program leaves you exposed to fraud, compliance gaps, and inefficiency. Switching to a managed CPM program could be right for you if you are looking for visibility and control to keep spend in check, safeguard compliance, and make mileage reporting painless for employees.

Next Steps Toward a Smarter Vehicle Program

No two companies are the same, and no single vehicle program works for every situation. By recognizing where your current program is showing strain, you will know if it’s time to adopt a tailored approach that reduces costs, minimizes risk, and keeps employees satisfied. Organizations that make the shift consistently see measurable ROI, stronger compliance, and more satisfied employees.

Talk to a Motus expert to learn how to optimize spend, reduce risk, and increase productivity for your driving employees today.