Provide mobile workers with a reimbursement for the business use of their home office. What does that include?

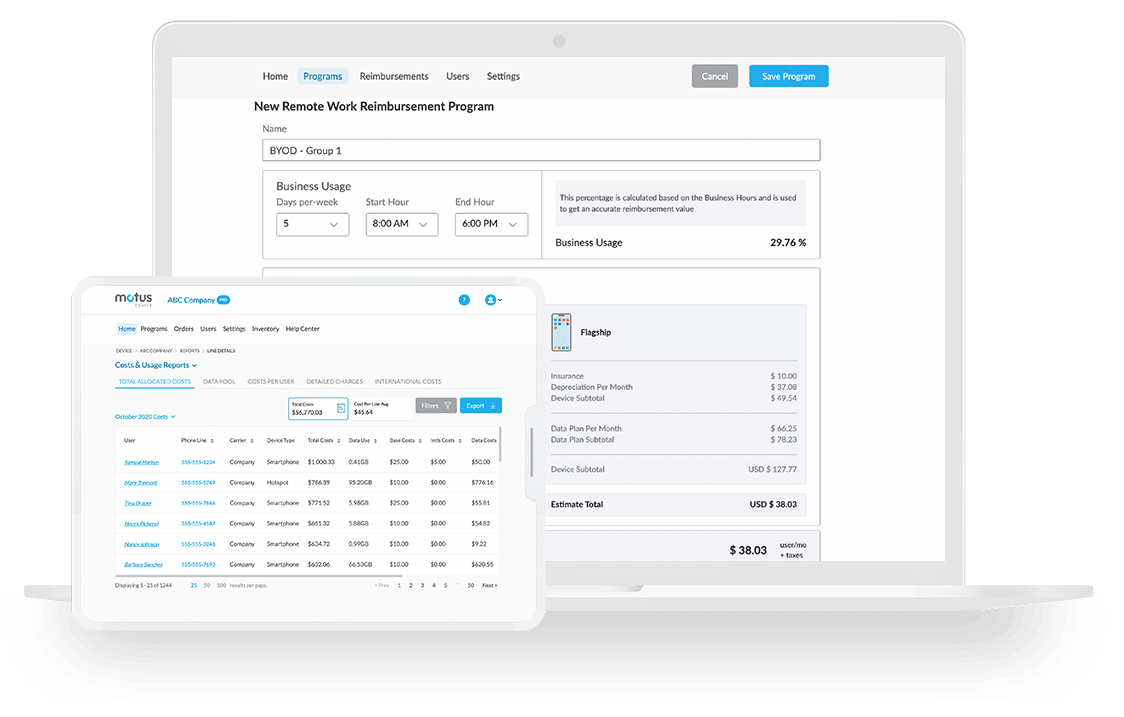

Customized Programs

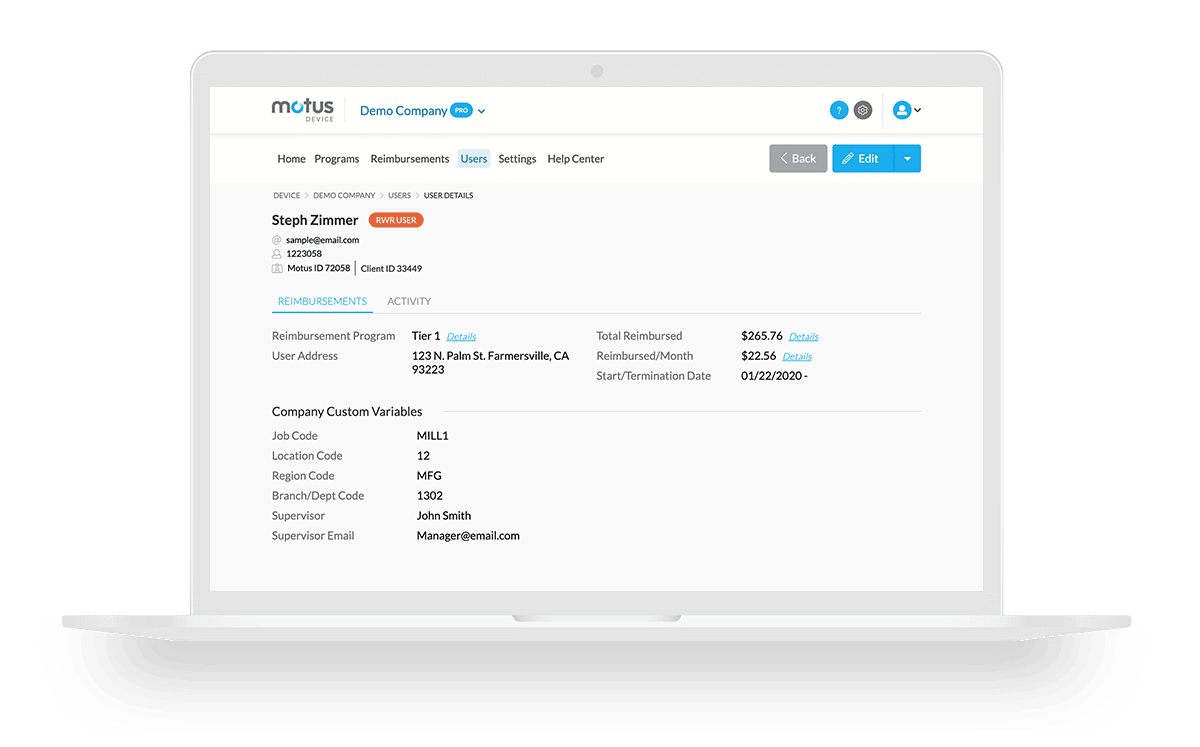

Customized Programs

Comprehensive Reporting

Comprehensive Reporting

The Motus Platform

For small companies just starting out or corporations that span the country and beyond, Motus has the platform to calculate reimbursement rates for your diverse business needs.

There’s more to WorkAnywhere reimbursements than what they provide.

*Customer Stats and Metrics:

All data, statistics, and testimonials are generated and validated through TechValidate and G2, third-party research organizations. Motus customers review our technology and service through TechValidate and G2 to ensure accuracy and truthfulness.