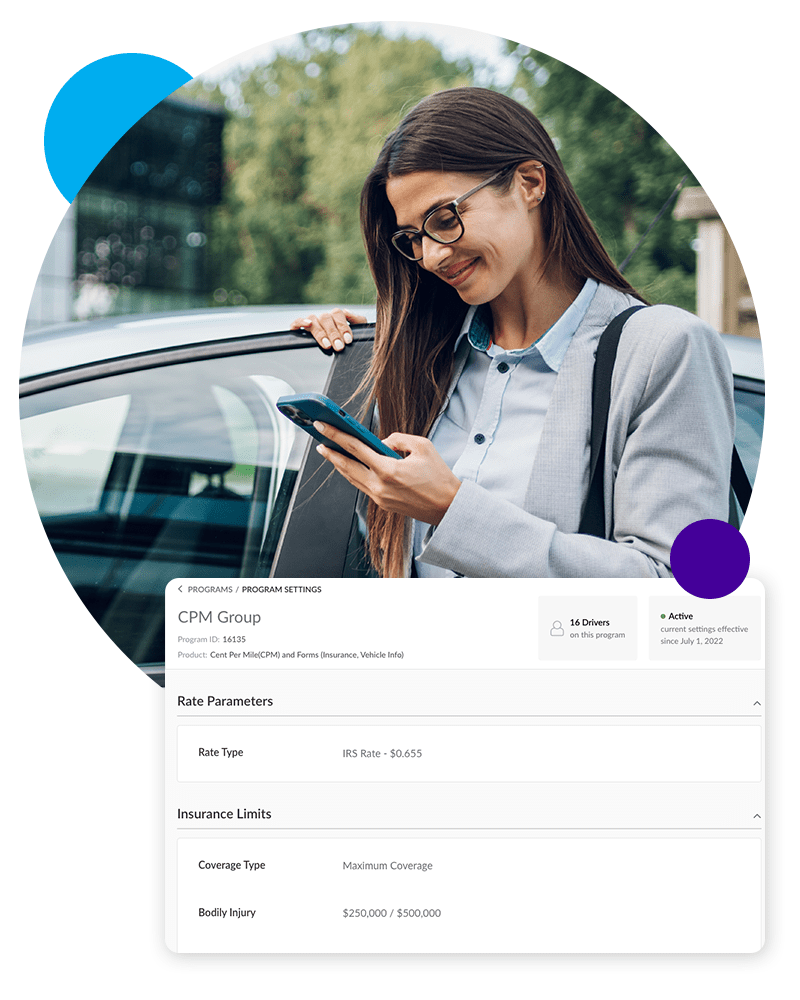

CPM programs are a good fit for low and mid-mileage drivers to accurately reimburse for business travel in personal vehicles, using the IRS mileage standard or other per-mile rate.

Every organization has drivers with unique needs based on how much they drive, their role type and more. Motus enables companies to design programs to meet the needs of every driver, leading to optimal results.

With a Motus CPM program, businesses can:

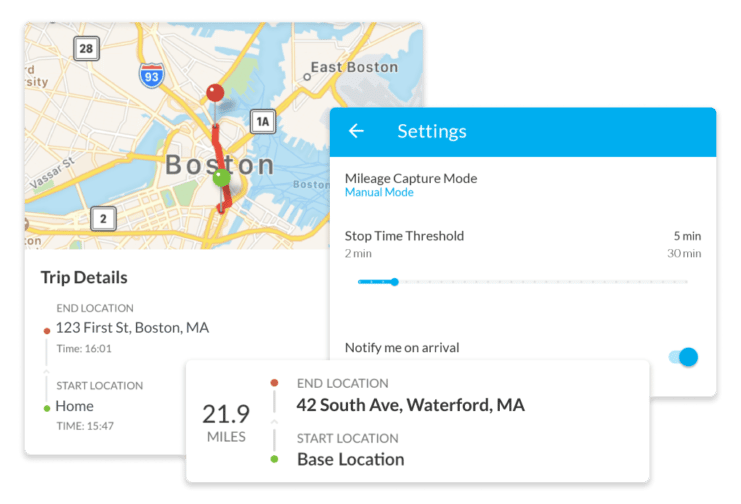

Motus allows program administrators to easily monitor and manage CPM side by side with other vehicle reimbursement spend. Visibility across driver groups makes it easy to align drivers to programs that fit them best. Flexible workflows allow companies to run reimbursement programs that align to their organizational needs.

*Customer Stats and Metrics:

All data, statistics, and testimonials are generated and validated through TechValidate and G2, third-party research organizations. Motus customers review our technology and service through TechValidate and G2 to ensure accuracy and truthfulness.