Car allowances are simple. However, without accurate mileage tracking, a car allowance is considered additional income.

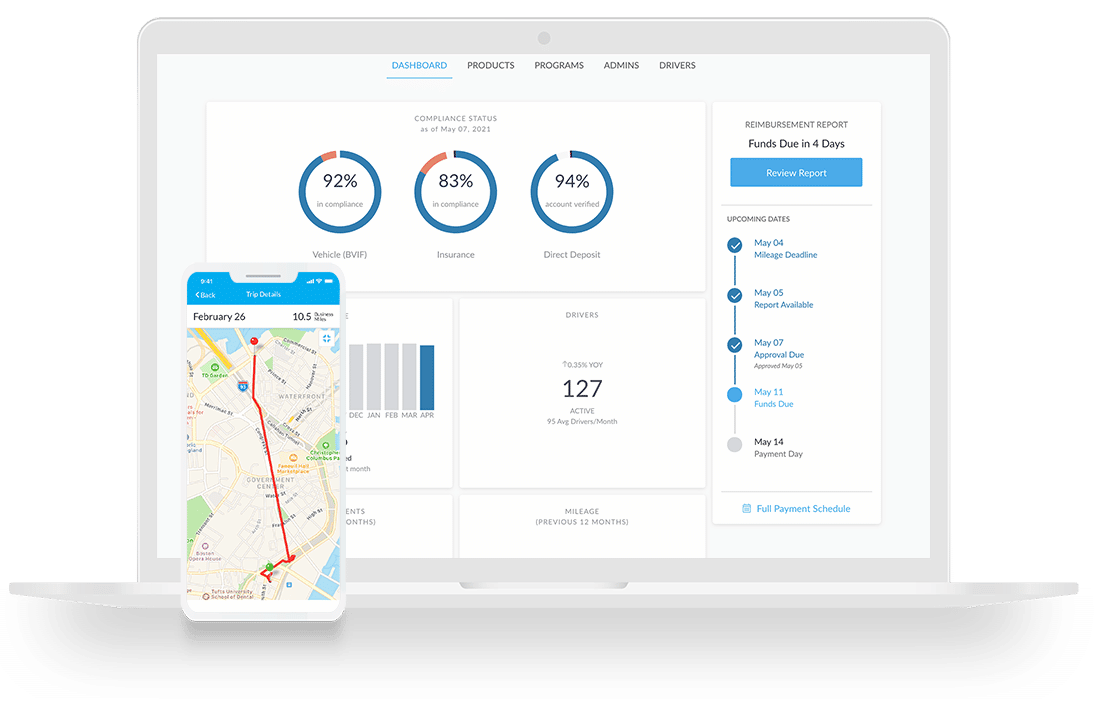

Visibility & Oversight

Visibility & Oversight

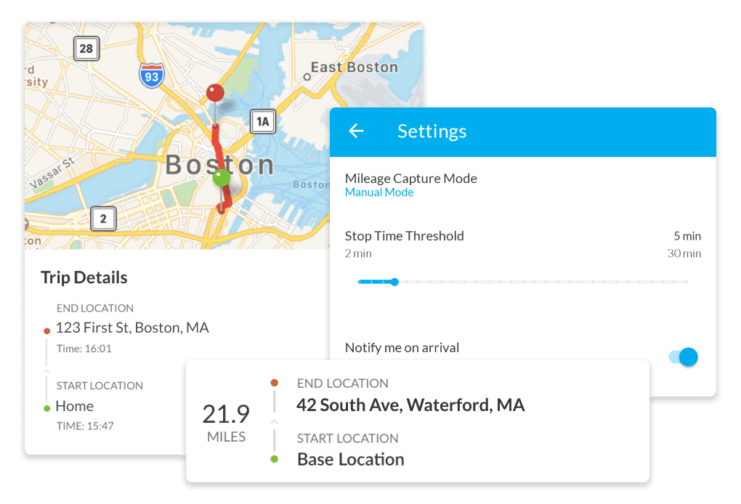

Automated Mileage Capture

Automated Mileage Capture

The Motus Platform

For small companies just starting out or corporations that have been around for decades, an accountable allowance will reduce tax waste and put more money in your employees’ pockets.

While an accountable allowance can benefit both employer and employee, better alternatives exist.

*Customer Stats and Metrics:

All data, statistics, and testimonials are generated and validated through TechValidate and G2, third-party research organizations. Motus customers review our technology and service through TechValidate and G2 to ensure accuracy and truthfulness.