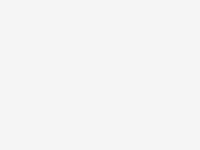

With the Motus App, employees now have access to automatic mileage capture, GPS-verified mileage logs, in-app forms submission and monthly mileage-submission reminders.

By simplifying the mileage tracking process, our the Motus App provides your employees full control over the business mileage they capture and submit, while reducing the administrative time you spend verifying accurate mileage logs.

Say goodbye to limitations by pairing the Motus App with a vehicle program. Gain powerful tools to monitor and manage your entire vehicle reimbursement program – from IRS compliant mileage logs, and reimbursing employees to informative reporting on your entire program.

Motus is great for companies that…

Average Cost Savings

Experience the Motus Difference

The Motus App has made mileage tracking more efficient while saving administrative time and money. It has also made being IRS compliant very simple and efficient.

– Controller at Small Industrial Manufacturing business

Motus … offer[s] top notch technical solutions for our drivers to use to capture and report their trips for reimbursement. Their website is state of the art and is updated as new features are offered instead of just a plug in and go option that is never changed.

– Administrator at a Mid-market company

We have been able to cut back on overall costs by using the Motus App.

– Administrator at a Mid-market company

Since implementation, Motus has been using their advanced technology to seamlessly handle our automobile reimbursement program. Unlike with many vendors, their customer service team is also top-notch and easy to reach.

– Administrator at Mid-Market company

*Customer Stats and Metrics:

All data, statistics, and testimonials are generated and validated through TechValidate and G2, third-party research organizations. Motus customers review our technology and service through TechValidate and G2 to ensure accuracy and truthfulness.

Contact us today or take a virtual tour of the Motus Platform.