Motus is the leading solution to manage the benefits, risk, cost and complexity of vehicle reimbursement. Offering powerful yet simple solutions for every driver, Motus helps companies optimize spend, automate time-consuming tasks and adapt to changing business objectives.

Unlike one-size-fits-all programs, Fixed and Variable Rate (FAVR) programs reimburse employees for the fixed and variable costs of vehicle ownership, localized to the places employees live and work. The FAVR methodology is an IRS-backed, highly customizable, tax-free program that uses five cost components to accurately reimburse drivers, allows employers to optimize spend, improves employee satisfaction and more.

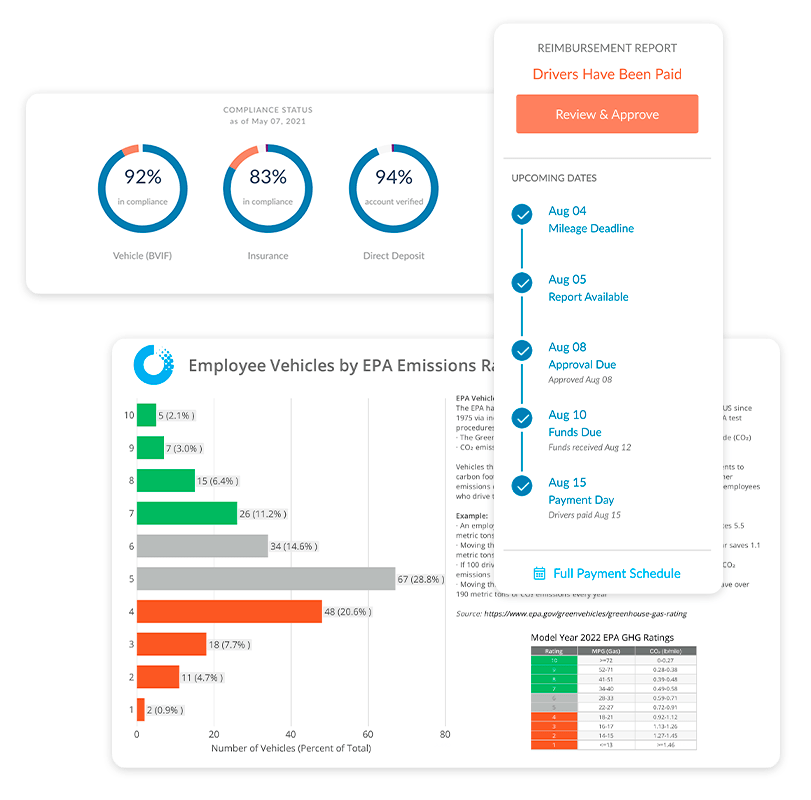

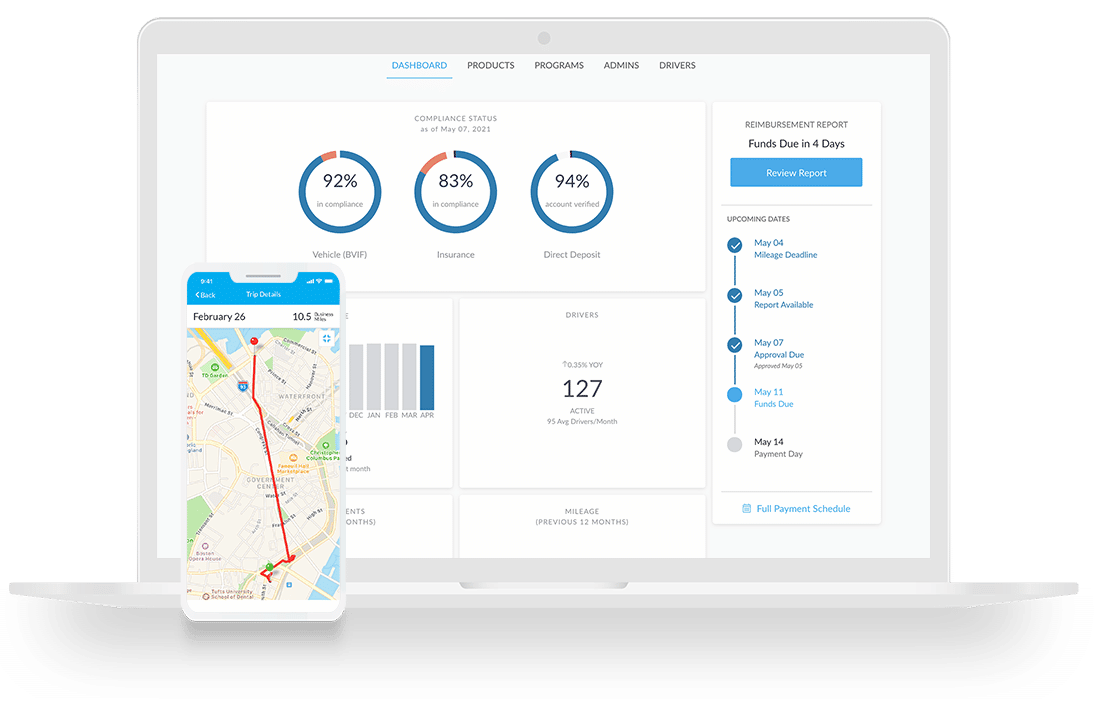

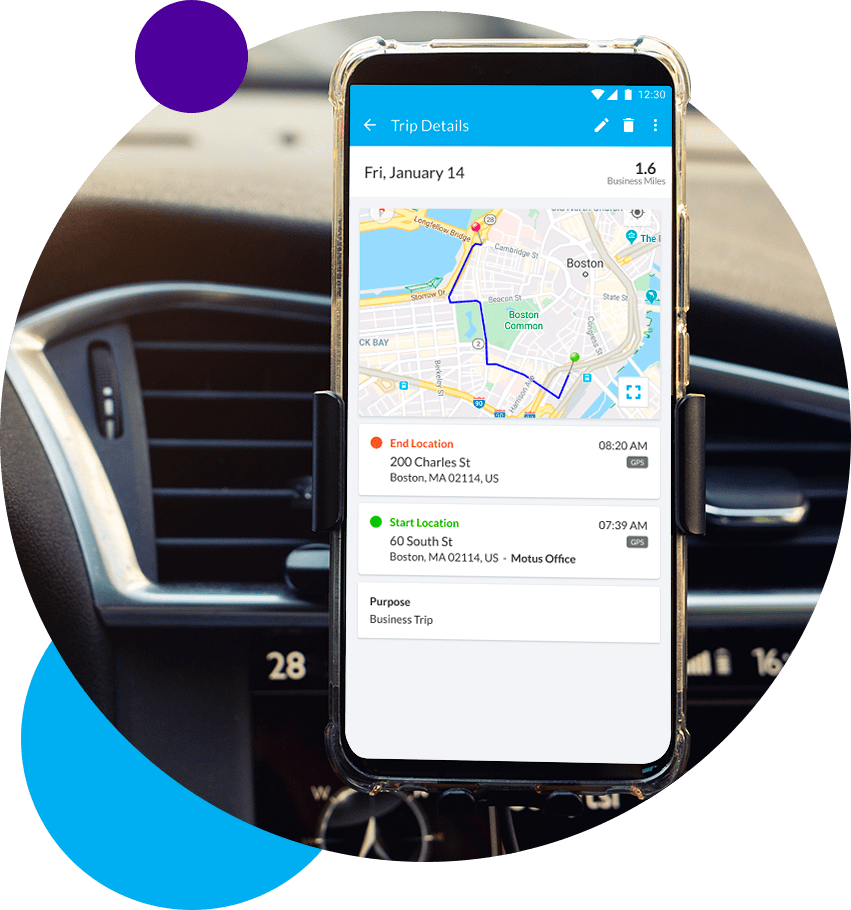

The Motus FAVR solution offers several benefits for your business driving program. In addition to making the entire process more accessible, simple and cost-effective for your organization, you can experience more control over your vehicle reimbursement program while maintaining compliance.

Other benefits include:

A cents-per-mile (CPM) reimbursement program can function as a stand-alone solution and as a complement to other vehicle programs.

The benefits of Motus CPM programs include:

Create an accountable allowance to reduce tax waste and increase employee take home amounts.

Car allowances are simple to administer, but without accurate mileage tracking, a car allowance is considered taxable income.

The benefits of Motus Allowance programs include:

Store owners get custom, IRS-compliant mileage reimbursement rates catered to their needs. Motus Rates optimize costs so franchises can reinvest in their business and employees.

The benefits of Motus Rates extend beyond labor law compliance and reduced costs:

*Customer Stats and Metrics:

All data, statistics, and testimonials are generated and validated through TechValidate and G2, third-party research organizations. Motus customers review our technology and service through TechValidate and G2 to ensure accuracy and truthfulness.