Inflation has impacted everyone in the U.S. As a result, Social Security recipients received 5.9% and 8.7% increases over the past two years respectively. The Society for Human Resource Management predicts that 2023 average salaries will increase 4.6% but still lag behind inflation. Transferees are experiencing inflation when they relocate. But they aren’t the only ones. Because it is impacting all employees, it is more of a compensation issue than a relocation specific issue. One of the biggest culprits? Increased mortgage interest rates.

Similarly, increased rents and home market values are impacting anyone who is moving. However, almost all markets have increased. Homeowners should be receiving more when they sell their current homes due to the higher values. Certain markets have appreciated more rapidly than others. However, even if the destination housing market has appreciated 10% more than the origin housing market, the annual increase in a cost-of-living calculation, when the mortgage is amortized over 30 years, is ~2% annually.

The largest factor impacting transferees, specifically homeowners, over the past year is the increase in mortgage interest rates. According to FreddieMac, in the first week of 2022, the average 30-year fixed rate mortgage was 3.125%. By the first week of January 2023, the rate had doubled to 6.25%. This has impacted everyone financing a home. However, those moving to higher cost housing locations have seen a disproportionate increase in their costs. Let’s Look at some examples.

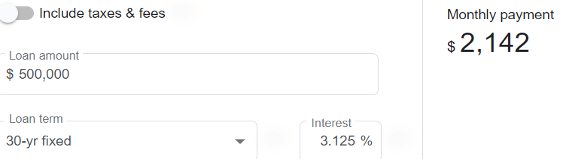

Say an individual bought a $625,000 home in January of 2022 in City A, with 20% down, at 3.125%. Their monthly principal and interest payment on the $500,000 30-year mortgage would be $2,142 ($25,704 annually).

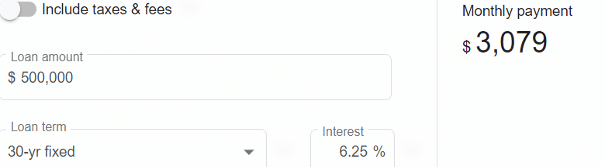

Had the same home been financed in City A in January of 2023, at 6.25%, assuming the home market value stayed the same, the monthly payment would be $3,079/month ($36,948 annually). Costs increased by $937 per month ($11,244 annually) for the same home in one year strictly due to increased mortgage rates. Everyone who is buying a home, regardless of whether they relocated, has been impacted by higher mortgage rates. Think City A is bad? It’s even worse in City B.

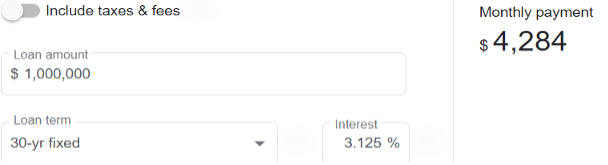

If an individual purchased a home in City B, where the same size/profile home is twice as expensive, $1,250,000, after a 20% down payment, their payment a year ago on the $1,000,000 30-year mortgage would have been $4,284 monthly ($51,408 per year).

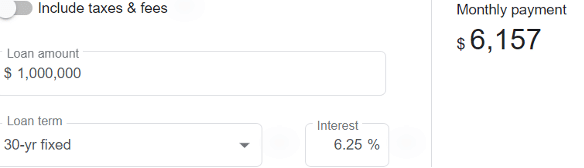

That same home in City B in January of 2023, assuming no appreciation, would be $6,157 monthly ($73,884 per year). Costs increased by $1,873 per month ($22,476 annually), for the same home in one year strictly due to increased mortgage rates.

Had an individual moved from City A in 2022 to City B in 2022, their annual principal and interest mortgage payments would have increased by $25,704. Let’s assume an average salary and all other factors remain the same between the locations: taxes, transportation costs, and goods/services. The doubling of home market values between the locations would have increased the cost-of-living differential by 25.7%.

Assuming all the same factors, the mortgage costs to move between City A in 2023 to City B in 2023 increased by $36,936, resulting in an increased cost-of-living differential of 36.9%! The impact of higher interest rates has led to an increase in the overall COLA differential, with all other factors being constant, of 11.2% (from 25.7% to 36.9%) in this example. The overall change in the cost-of-living is much more now than it was a year ago. That’s strictly due to the impact of higher interest rates.

For a corporate relocation program paying 100% differential in the first year of a move, this would mean their costs have increased by over $11K in the first year alone for this one average transferee. For companies with multi-year payouts, and/or moving numerous individuals to higher cost locations, the cumulative impact can and will be significant.

Two other factors further exacerbate the issue. The first is the changes to the federal taxation on mortgage interest in 2018 as part of the Tax Cuts and Jobs Act. This limits interest that can be deducted to the first $750,000 of a mortgage. With the increase in rates, the impact of not being able to deduct all the interest is disproportionately impacting those moving to higher housing cost locations.

Lastly, cost-of-living calculations assume current mortgage rates at both the origin and destination — 6.25% to 6.25% for January 2023 in this example. Because of this, it doesn’t take into consideration the fact that most individuals likely purchased their home, or refinanced, when rates were in the ~3% to ~4% range. Any individual who is relocating, even those moving to a location with similar housing costs, will be negatively impacted by the higher rates. When moving to a higher cost housing market, individuals will be paying the increased rate on the amount equivalent to what they currently have financed on their origin home PLUS the additional interest on the differential in increased housing costs.

Because of higher mortgage rates, all organizations moving individuals to higher cost housing locations are experiencing increased costs. Does a COLA cover all of the increased costs related to higher interest rates? Probably not. It could be argued that some type of mortgage interest differential (MIDA) and a COLA could both be justified to meet the increased cost. Companies should consult with their Cost-of-Living data providers, Relocation Management Companies and/or mortgage lenders to help find a solution that will work best for their program.

Want to learn more about MIDAs or additional insights on this topic from industry experts? Contact us today.