Simply put – a hybrid vehicle program is a program that brings all of your mobile employees together under one consistent system of record. It’s designed to enhance visibility and control expenses. How? By effectively prescribing mobile employees to the appropriate reimbursement method, best suited to their needs.

A hybrid vehicle program is defined by a company’s policy and informed by an employee’s job function. It’s a combination of any of these four types of programs: cents-per-mile rate reimbursement, car allowance, personalized mileage reimbursement and company-provided cars.

If you’re like most businesses, not all of your employees have the same job. And if your workforce isn’t uniform, how often your employees drive for work probably isn’t uniform either. Your business likely needs to implement a hybrid vehicle program, but you might not have considered this solution before. Why? It’s likely because you currently have no ability to marry the data or understand the “full picture.”

Let’s walk through a few examples of when a hybrid vehicle program is the best choice for businesses and their mobile employees.

“We have regional salespeople who receive company-provided cars and executives that drive to meetings and the airport several times a month. These executives receive $1K as a monthly allowance.”

“We have regional salespeople and executives that receive company-provided cars, and for our in-store employees/marketing team, we reimburse a cents-per-mile rate. We also give our Account Managers $600 as a monthly allowance.”

Here’s a simple test to gauge if a hybrid vehicle program makes sense for you.

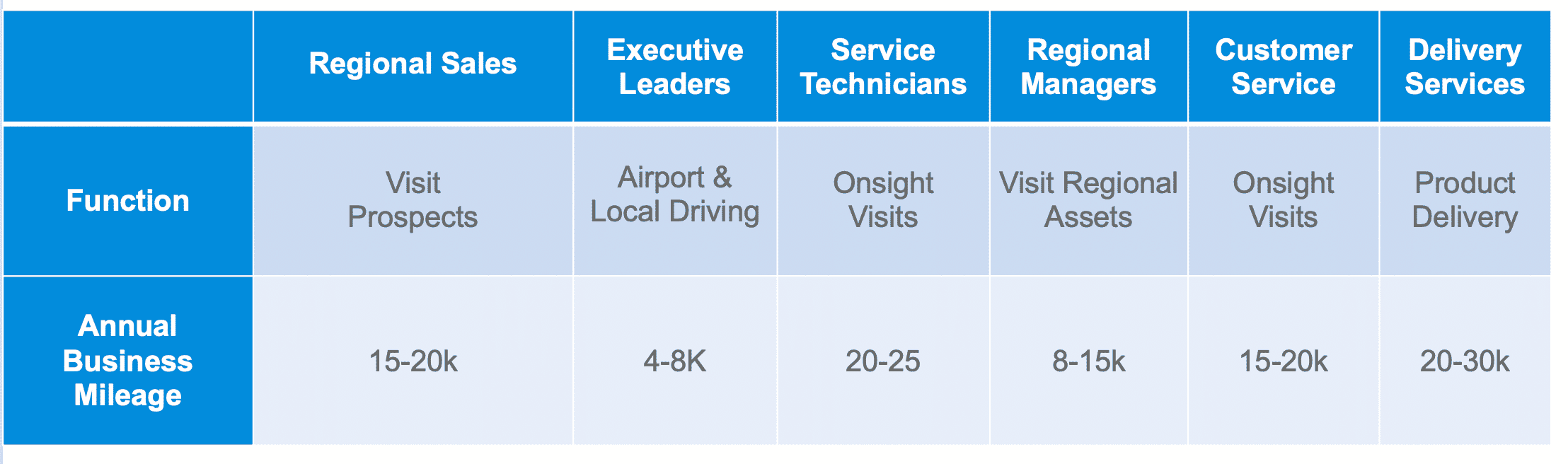

In the chart below, if more than one of the employee personas match your workforce, you should consider a hybrid approach to vehicle reimbursement.

The bottom line is that business leaders have a choice in the methods and tools they use to manage their mobile workforce and line item expense for mileage reimbursement. Depending on the situation, most of the options are reasonable to varying degrees, so long as they are administered effectively with technology, data and business intelligence.

Interested in evaluating a hybrid vehicle program? Reach out to us! We’d be happy to help you figure out what type of program meets your business-specific needs.