Consumers have been wary about purchases big and small these days, as everything from the price of eggs to the costs of cars have seen sharp spikes in the face of recent global economic uncertainty.

Now, as executive orders take effect that put major tariffs on both foreign trade partners and valuable manufacturing materials, all signs are pointing to even more price jumps—especially if you’re shopping for a new car.

That’s because despite the brand name on the model, almost no car that’s deemed ‘made in America’ is 100 percent manufactured on American soil.

For starters, it’s estimated by S&P Global Mobility that roughly 3.6 million vehicles sold in the United States by domestic, European and Asian brands were assembled in Mexican factories last year. Drilling down, even cars that come out of factories in the United States rely on a North American, cross-border supply chain that has been designed by both the government and private sector to be almost borderless.

As Kelley Blue Book explains, parts “can cross the border several times before a vehicle is completed,” which the Washington Post emphasizes with the estimate that “more than half of goods classified as automotive vehicles, parts, and engines come from Canada and Mexico.”

So, with 25 percent tariffs on imports from Canada and Mexico—along with 20 percent on exports from China—going into effect immediately (alongside upcoming 25 percent tariffs on steel and aluminum forecasted for the coming weeks) what can consumers and businesses expect?

We’ll break down the potential implications as well as how buyers can navigate this new reality when shopping for a car to buy or lease.

Tariffs, by the numbers

Despite many of the implications remaining in flux, virtually every economist following the news expects car prices to balloon as a direct result.

One study conducted in January by U.S.-based Wolfe Research found that the early restrictions floated by the Trump administration would immediately cause a price jump of $3,000 on new vehicles once enacted.

A similar report was published by T.D. Economics in late January supporting the $3,000 average, though this study detailed the potential for much more variability in the event of retaliation from Canada.

Flash forward to March, and researchers from Anderson Economic Group (AEG) have added more detail to the analysis, estimating that the average price increase for full-size SUVs—one of the most popular segments of the U.S. auto market—would be at least $9,000.

As AEG CEO Patrick Anderson has been quoted in both the MITPress and Detroit Free Press explaining: “If you don’t make production adjustments or shut down lines, it could be above $10,000.”

In fact, the nation’s top-selling model—the Ford F150—is among the biggest immediate ‘casualties’ of the tariffs, as Ford announced to suppliers in recent weeks that they will be delaying the launch of the newest version of the model as the brand rethinks its supply chain strategy.

It’s not just about MSRP—or even new cars

Unfortunately, the price shock continues beyond buying and leasing new cars. A recent study from Insurify found that “tariffs would contribute to the national average cost of full-coverage car insurance increasing 8 percent by the end of 2025, from $2,313 to $2,502.”

This comes as estimates show average insurance premiums already skyrocketed by 22 percent in 2024.

To that end, a recent Axios report found that the number of cars considered ‘totaled’ in vehicle collisions reached an all-time high of 23 percent in 2023, which has had the downstream impact of higher replacement costs and higher insurance premiums across the board.

This coincides with a rise in the cost of repairs and new costs that have already been felt as “smart” technology has turned even minor fender-benders into costly endeavors.

The good news? There’s (some) time to act

As we saw during the pandemic when manufacturing of new cars took a hit during factory closures, we can expect demand for used cars to start filling the gap for consumers.

While Kelley Blue Book reports that dealers were “slightly short’ on used car inventory at the start of tax season, most automakers aim to keep a 75-day supply of used cars—60 days with the dealer, 15 in transit—at any given time.

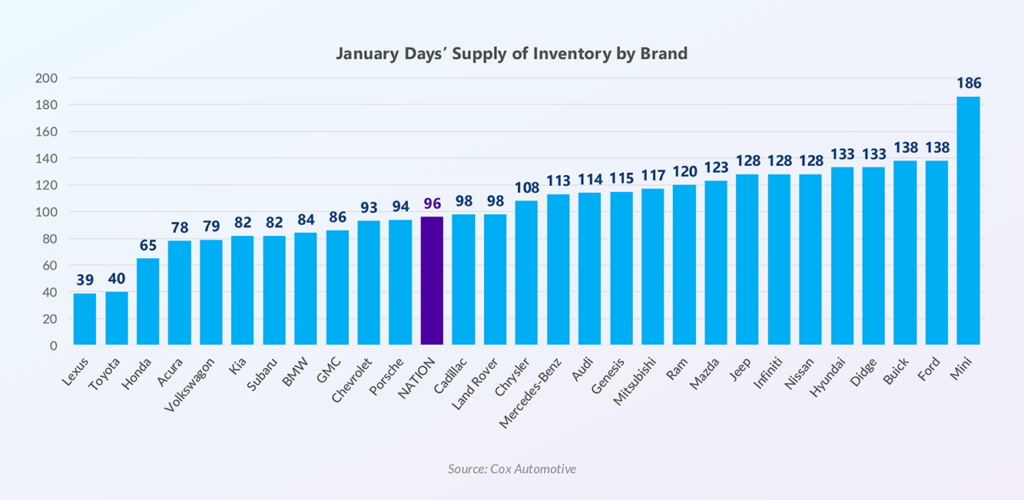

As of January, the national average for automakers’ used car inventory was 96 days, but some automakers—namely Jaguar and Lincoln—had more than twice that inventory, while Mini (186), Ford (138), Buick (138) and Dodge (133) all reported healthy supplies of more wallet-friendly used vehicle options for consumers.

On the flip side, it’s estimated that Toyota and Lexus, which both reported only about 40 days of used car inventory as of January, are the brands that will likely have the fewest bargains for consumers.

More flexible vehicle programs for on- and off-hour driving

While there is still a lot of political wheeling and dealing that needs to play out before we can fully understand the long-tail implications of tariffs, both businesses and consumers can adopt new strategies to minimize their cost burden.

For businesses, this all starts with adopting vehicle program solutions that consider both the fixed and variable factors that dictate their employees’ true ‘cost of living’ and driving for work. The benefits here are twofold:

- For Businesses: Rather than forcing companies to take on the sky-high insurance liability that comes with managing a fleet of company cars, businesses can adopt reimbursement models that allow drivers to use their personal vehicles for work. This not just de-risks the business from the impact of rising premiums but also takes the increasing buying, leasing and maintenance costs for a fleet of vehicles off the company’s bottom line.

- For Drivers: Rather than getting locked into driving a vehicle that doesn’t fit your professional or personal needs, drivers can choose models that are a better choice—and enjoy fair, accurate, tax-free reimbursements as a result. While they will have to take on the insurance premiums and costs, they have flexibility in choosing a more fuel-efficient model, for instance—or even selling their current car at a premium as resale values are poised to spike.

Ultimately, the more flexible businesses and consumers can be with the programs that enable them to drive for work and live their day-to-day lives, the better.

To learn more about how to map out a vehicle program that satisfies both your drivers and your company, talk to a member of the Motus team today.

2025 Tariffs FAQ

How will new tariffs affect car prices in 2025?

Economists predict significant price increases for new vehicles due to recent tariffs. A study by Wolfe Research suggests an immediate price jump of approximately $3,000 for new vehicles. More dramatically, the Anderson Economic Group estimates that full-size SUVs could see price increases of at least $9,000, with CEO Patrick Anderson noting that without production adjustments, price increass could exceed $10,000. These increases stem from 25% tariffs on imports from Canada and Mexico, and 20% tariffs on exports from China, directly impacting the complex, cross-border automotive supply chain.

Are these tariffs only affecting new car purchases?

No, the impact extends far beyond new car purchases. The tariffs are creating a ripple effect across the entire automotive ecosystem:

- Car insurance premiums are expected to increase by 8% by the end of 2025

- Used car markets are experiencing significant shifts

- Repair costs are rising, particularly for technologically advanced vehicles

- Some manufacturers, like Ford, are delaying new model launches to rethink supply chain strategies

The automotive industry is facing widespread changes that will affect consumers, businesses, and insurance providers alike.

How are car manufacturers responding to these tariffs?

Manufacturers are adapting in several key ways:

- Reassessing supply chain strategies to minimize tariff impacts

- Adjusting production lines and inventory management

- Exploring alternative manufacturing and sourcing options

- Delaying new model launches (e.g., Ford F150)

The complexity of modern automotive manufacturing means that almost no “American-made” car is 100% produced on U.S. soil. With parts crossing borders multiple times during production, manufacturers must be incredibly strategic in their response to these tariffs.

What strategies can businesses and consumers use to mitigate these increased costs?

Businesses and consumers can adopt more flexible vehicle programs to manage rising costs:

- Businesses can implement reimbursement models that use employees’ personal vehicles

- This approach reduces fleet maintenance costs and insurance liabilities

- Employees gain flexibility in vehicle choice and potential financial benefits

- Consumers can explore used car markets, with some brands like Ford, Buick, and Dodge offering healthy used car inventories

- Drivers can consider more fuel-efficient models or take advantage of potentially rising resale values

Where can I get more information about navigating these automotive market changes?

For detailed guidance on adapting to these market changes

- Consulting with automotive industry experts

- Exploring flexible vehicle program solutions

- Staying informed about ongoing tariff developments

- Reaching out to specialized teams like Motus for personalized advice on vehicle program strategies

Companies like Motus offer comprehensive insights into managing the complex landscape of automotive costs, insurance, and reimbursement in light of these significant tariff changes.