What is Crude Oil and Who Are the Top Producers?

To kick off our first Oil Check post, we’re going to give a bit of background information on what goes into the price of gas and the top crude oil producers. We’ll start with the cost. Supply and demand are major factors. If the global production is higher than the global need, then fuel isn’t as highly valued. Global oil production is at the highest its been to match the needs of the growing economies of several countries including the U.S. and China. But there’s more that goes into the price of gas than the gas itself. And that goes even beyond who has it and who wants it.

Over the course of 2017 most of it, about 57% according to the U.S. Energy Information Administration, was crude oil. Refining takes a chunk, marketing and distribution gets a cut, and obviously there are taxes. But it’s the base product, crude oil, that sees the highest expense. It’s also this base product that sees the most change. Because oil market dynamics affect the price of crude. And that directly impacts the prices we pay at the pump for fuel.

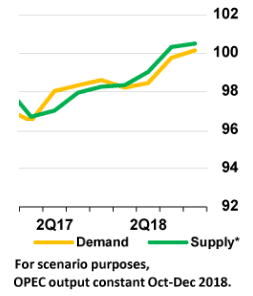

Global oil markets are in a volatile state. One month ago, analysts were predicting upward pressure on oil prices due to tightening supply in Q4, and prices accelerated. Today, prices are trending down, but that isn’t a guarantee of what the future holds. Supply and demand are tracking in a fragile balance, with supply slightly exceeding demand in recent history. Due to a recent stirring in international politics, the supply of crude oil is expected to shrink starting in November.

Source: International Energy Agency, Oil Market Report October 2018

So who are the top crude oil producers? What are they doing about the situation? Digging into the supply side of the equation, here are some notes on the top three largest crude oil producers:

Saudi Arabia

Saudi Arabia originally claimed that it had spare capacity to increase exports to 12.5 million barrels/day (mb/d). Then reports surfaced that it may not be able to sustain increased production over 11 mb/d. Increasing production to 12 mb/d is unknown territory. There is doubt among some analysts that this production level is achievable.

Russia

Russia recently experienced a new post-Soviet record high in September, producing about 11.3 mb/d. This helped close some of the emerging gap. There are also reports that Russia will further increase production to 11.8 mb/d in 2019, but this is also uncharted territory and bears close monitoring.

U.S.

In recent years, shale oil has been able to make up for supply shortfalls in other parts of the world and was expected to continue growing. However, constraints on increasing production over current levels have emerged- pipeline capacity is limiting production growth. Those constraints include building additional pipelines, which can be a lengthy process. Some steps are being taken to speed up the process. Repurposing a natural gas pipeline for shale oil is one of them. But even this cannot make up the entire anticipated supply gap.

Where do other crude oil producers fit into this? And what market-disrupting factors are experts keeping an eye out for? Find out in this Oil Check! Don’t forget to subscribe to our blog to stay in the know.