Whether you were lucky enough to experience gas at less than $2 last year or not, those prices are long gone. If you’ve followed any of our previous oil checks, you’re aware that the price of gas is heavily influenced by the price of the crude oil used to distill gasoline. But with prices on the rise, questions arise. Why was it so cheap last Summer? Why is it becoming so expensive now? In this post, we’ll outline the influences on the rise in gas prices and when we can hope to see a decline in this expense.

Price of Oil

For most of the pandemic, fuel prices have been below typical levels. This is largely due to the global surplus of oil caused by the rapid pause on travel and shipping in early 2020. However, in the past few months, large oil distributors have focused on rapid rebalancing.

For nearly a year, OPEC+ has held to production caps across all its traditional and expanded membership. Since demand was exceptionally low for most of 2020, major oil producers like Saudi Arabia had to weather low prices. In January, Saudi Arabia decided to accelerate the market rebalancing by cutting an additional million barrels per day (b/d) of oil production.

Outside of OPEC’s influence, another large producer was also forced to make cuts. EIA estimates U.S. crude oil production declined by 0.5 million b/d in February as a result of extremely cold weather that caused well freeze-offs. This additional reduction in supply occurred against a backdrop of rising global oil demand.

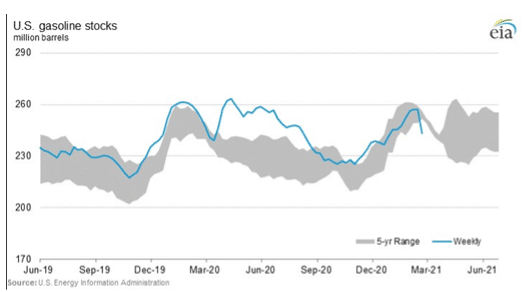

Constricting Supply

As a result of OPEC+ capping their production and mother nature limiting that of the U.S., global oil markets constricted severely last month. According to EIA, February global liquid fuel supplies fell by 1.8 million b/d from January. Which was met with a rise in liquid fuels consumption of 2.2 million b/d. The result? The strongest monthly global oil inventory draw since inventories began falling in mid-2020. Initial estimates show February global oil inventory draws were 0.6 million b/d larger than forecast last month.

Though driving levels have not recovered to pre-pandemic levels, demand has been steadily increasing over recent weeks. Increased driving activity is doing its part to quickly rebalance world oil supply, along with some unexpected influencer events. Some refineries affected by the Texas Freeze are still coming back online, and it may take others until April at the earliest. Another disruption occurred when Yemen rebels attacked a key facility in Saudi Arabia. Though the attack itself does not appear to have affected production, prolonged targeting of this and similar facilities could have greater impact.

Developing Demand

As vaccinations rates and economic activity increase, so has the demand for oil. Due to the production caps and acts of nature, this demand for fuel is unfortunately beginning to exceed current production. How close are we to pre-pandemic levels? According to EIA, “the world consumed 95.9 million b/d of petroleum and liquid fluids in February 2021… down 1.6 million b/d from February 2020.” This may only be an estimate, but it indicates the smallest year-over-year decline since the pandemic began.

Return of Low Gas Prices

Unfortunately, paying less at the pump is unlikely to happen in the next few months. As outlined in a previous oil check, refineries need to retool to produce summer’s gasoline blend. This blend is also more expensive to refine, which typically results in higher costs of summer fuel. The timing of all these—intentional and unplanned—market influencing events has merged into a solid floor under fuel prices. In short, we’re unlikely to see prices relax until June or July.

Given how consistent OPEC+ has been about their production caps, supply will likely remain constrained in the near term. Rising demand only works to guarantee that. Some are convinced that we will see demand reach pre-COVID levels during the summer. Others believe too much has changed about the way we work to believe demand will ever return to the levels of 2016 to 2019. Which is right? We won’t know until it happens. But in this uncertainty, the company with the most flexible vehicle program is best equipped for the situation. Check out our FAVR offering to learn more.