How do you measure the efficiency of your mobile workforce? It’s a question companies have been asking for years, with no clear, definitive answer. Some companies may measure efficiency by the number of miles reported. Others may measure by the increase in new business. Neither of these provide a true insight into the mobile workforce. Regardless, wherever there’s room for greater efficiency, employers strive for improvement. Here we’ll walk through factors potentially impacting efficiency in your mobile workforce and steps you can take towards improvement.

Pain Point: Reimbursement Equity

Reimbursing employees is important. In fact, many states have labor laws requiring it. It’s also important to reimburse employees fairly and accurately. Whether gas prices are painfully high or other factors impact their driving costs, mobile workers react to incentives. Let’s look at some examples.

Car Allowance Covers Too Little

With a car allowance, a mobile worker typically gets a stipend of $576 a month. Last month, that amount barely covered the cost of driving to and from client locations. This month, gas prices are higher and the schedule has more visits. By the end of the third week, the mobile worker is all out of their stipend.

In this situation, they’ve driven all the miles the company has covered. When that cost is coming out of their pocket, what incentive do they have to drive another week? Companies with car allowances aren’t the only ones running into this problem.

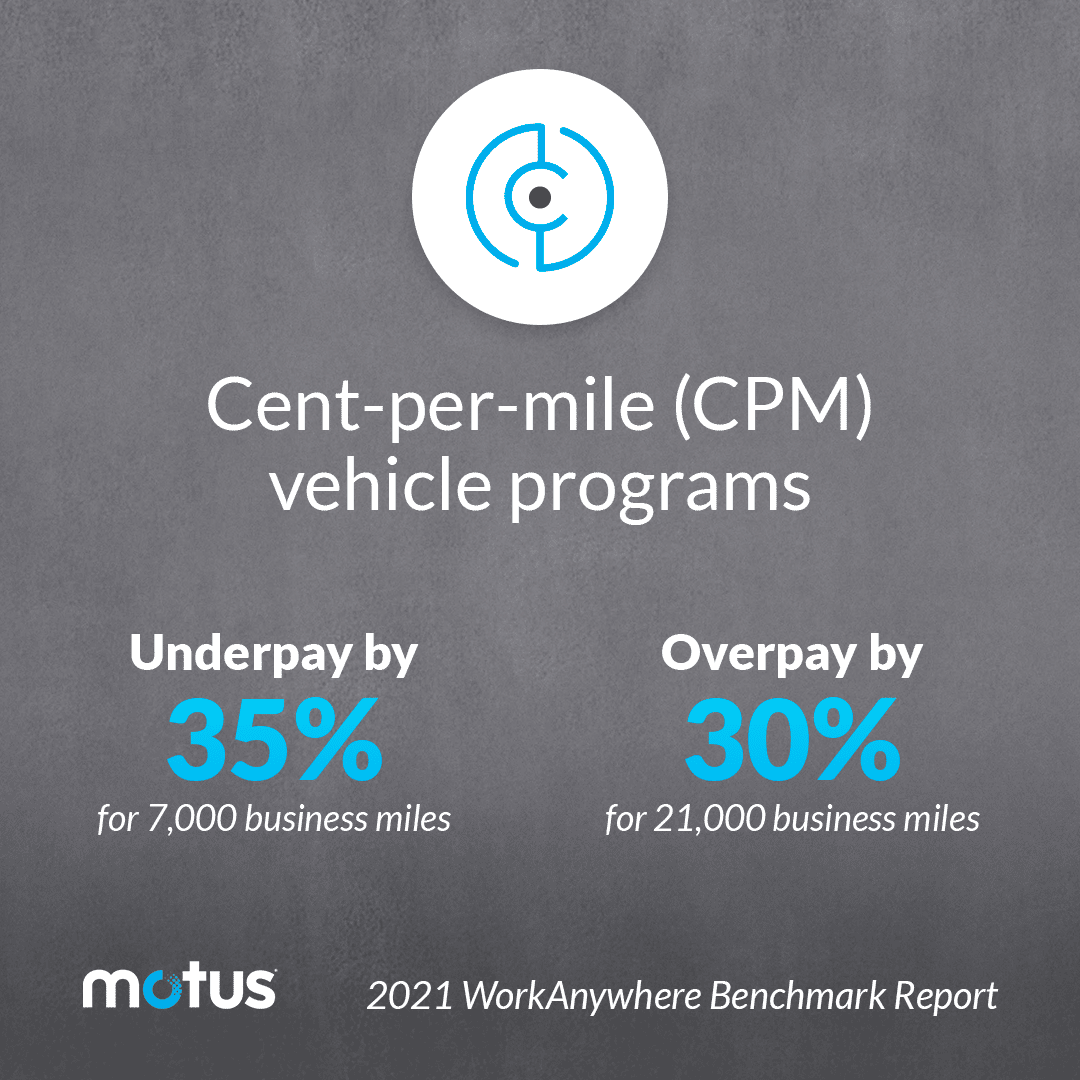

Short Changed with Cents-Per-Mile

A mobile worker receives a mileage reimbursement of $0.27 cents-per-mile. In their busiest weeks of driving, they’re on the road for maybe a hundred miles. Their Ford F-150 has a 23-gallon tank capacity that allows them to get around 16 miles per gallon. Each time they refuel, with gas around $4.60 per gallon, it costs about $105.80. For the average 368 miles they drive before needing to refuel, their reimbursement comes out to $99.36.

If that looks like a math problem, it is. And that problem falls squarely on the mobile worker. Not only does the CPM rate fail to cover the cost to fill their tank, it also fails to cover the costs of operating the vehicle. The more frequently you drive, the sooner your vehicle requires maintenance. This reimbursement will frustrate mobile workers and contribute to churn rate. Losing driving employees and training new hires takes time and money, reducing overall efficiency.

Solution: A Fair and Accurate Reimbursement

Mobile workers deserve a fair and accurate reimbursement. That doesn’t necessarily mean a higher car allowance or an increased CPM rate. Employees that drive for work should be reimbursed for costs specific to their location. Reimbursing people in different parts of the country the same amount doesn’t make sense. Under that system, some employees may be over reimbursed while others will certainly be under reimbursed.

Reimbursements should also take into account the total cost of vehicle ownership. Fuel isn’t the only expense of driving. There are costs that don’t change often, like insurance and registration, called fixed costs. And there are variable costs, like fuel and maintenance, that change more frequently. The fixed and variable rate (FAVR) reimbursement program provides reimbursements specific to employee locations and considers the true costs of vehicle ownership.

Pain Point: Mileage Logs

Mileage reimbursements and company-provided vehicle programs both require mileage logs, for opposite reasons. To receive mileage reimbursements, employees record their business trips they take in their personal vehicle. To avoid an IRS audit, employees driving business vehicles for personal use must record their mileage. Companies can also reduce tax waste in their car allowance program by having employees record and submit IRS compliant mileage logs.

Traditionally, mileage logs have been recorded manually. Employees capture the necessary information to make it IRS compliant, then submit the log to whichever department handles mileage reimbursement. This process takes valuable minutes out of an employee’s day. It also leaves the door wide open for a rat’s nest of mistakes that will require valuable time and resources to correct. That might not matter as much to a company with fleet vehicles. However, it’s something that companies offering mileage reimbursements or accountable allowances will be eager to avoid.

Solution: Mileage Capture App

Recording miles manually should be a thing of the past. Employers can boost efficiency by enabling mobile workers with a mileage capture app. Downloaded to their device, the right app will allow employees to record each trip and submit IRS compliant logs from anywhere with ease. This process also streamlines reimbursements, as sorting through and deciphering the scribbles of manual mileage logs will be replaced by a digital process.

Pain Point: Lacking Flexibility

Companies with fleet vehicles like to see them as an employee perk. And for some employees, they are. But it isn’t always the case. In fact, many would rather drive the vehicle they own. There’s a reason they bought it. They like it, feel comfortable in it. Fleet vehicles on the other hand, are passed from one employee to the next. That might be apparent from the quality, or odor of the interior. It might also be apparent from the maintenance and repair record.

Solution: Reimbursing Personal Vehicles

Reimbursing employees for the business use of their personal vehicles means mobile workers drive in a vehicle they’ve already chosen. They’re not trying to spend as little time as possible in a vehicle that’s already passed through the hands of a dozen other employees. They’re engaged behind the wheel that’s familiarly their own.

Pain Point: Lack of Visibility

All too often, you simply don’t know a better way until you can see it. That’s true of driving routes, assigned regions, reimbursement amounts and other essentials of your mobile workforce. But, and we said this in the introduction, there are some areas you simply lack visibility into. The mobile workforce is one of them. Or at least it has been.

Solution: Insight Into Your Mobile Workforce

Automating the process of capturing business miles benefits the mobile workforce in many ways. With the gathered data of your driving employees, you can analyze expense patterns, anticipating monthly spend and projecting future mileage reimbursements for the year.

You can also dig into employee travel, the time spent at locations and the routes they took. This level of insight will enable you to reward example employees for their method and work with struggling mobile workers to improve route efficiency.

Pain Point: Vehicle Accidents

Vehicle accidents have an outsized impact on mobile workforce efficiency. Depending on the vehicle program, companies can be exposed to serious risk. But, no matter the program, companies feel the impact of missing employees. And an alarming 100,000 workdays are lost due to accidents each year.

Solution: Driver Safety Program

Accidents happen. That doesn’t mean your company can’t do anything about it. With a comprehensive driver safety program, you can take both reactive and preventative measures to reduce the risk of accidents in your mobile workforce. The three essentials of a comprehensive vehicle program are insurance verification, MVR checks and individualized training.

Insurance verification ensures your driving employees have auto insurance. That may seem small, but companies that don’t verify may find themselves in a difficult position. Motor vehicle record (MVR) checks notify you of employee’s driving records. Depending on how frequently you pull these, you can hopefully catch troubling driving behavior before a serious accident. While there are many types of driver safety training, the best version assesses the individual’s current performance and assigns trainings specific to the gaps.

Making the Most of Efficiency

An operating mobile workforce at peak efficiency might seem like a daydream. That doesn’t mean your company can’t take steps towards improvement. Our list isn’t small: reimbursing fairly and accurately, enabling employees with automated mileage capture, offering flexibility in vehicle choice, gaining visibility into mobile workforce activity and reducing vehicle accidents. That doesn’t mean you can’t do it all with the right provider. Find out how Motus can help you bring your mobile workforce to a greater level of efficiency.