Car allowances are a popular vehicle program. The reason is simple: it’s easy. With a car allowance, companies use a single, company-wide rate to pay all employees for any business travel. That also makes it easy to account for the expense of business mileage. Unfortunately, that’s where the benefits end and why so many companies transition from car allowance to FAVR.

Downsides of Car Allowance

Put simply, car allowances don’t pay employees fairly. For example, companies may give each employee $576 a month to cover all business travel expenses. But, by not calculating individualized, location-specific reimbursements, companies usually end up either underpaying or overpaying workers. Not to mention, the IRS taxes each stipend as additional income. That’s why companies should consider transitioning from car allowance to fixed and variable rate (FAVR).

It’s easier to switch than you may think. With car allowance, employees already use their personal car for business purposes. FAVR encourages employees to continue using their own car, but it simply changes how their reimbursement is calculated.

Exploring the Abilities of FAVR

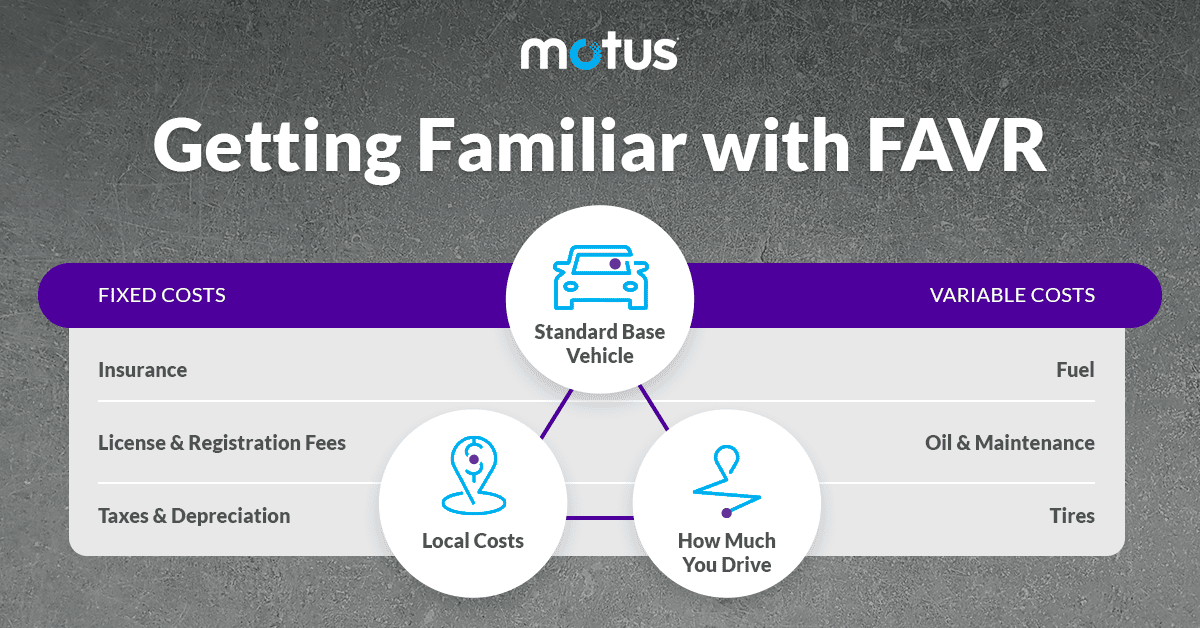

Companies have switched to fixed and variable rate (FAVR) programs to provide fair and accurate reimbursements that car allowances can’t manage. With this program, companies distribute customized reimbursements to each driving employee. These are based on their location-specific costs (e.g. gas, insurance, taxes, etc.) and their monthly business mileage. Unlike car allowances, FAVR is based on individualized driving costs.

Cost Control

FAVR is part of an IRS-approved revenue procedure. This means that FAVR programs aren’t subject to FICA taxes or income taxes. By removing tax liabilities and applying real-time geographic and mileage-related cost data, FAVR reduces tax waste and even produces soft savings. These include increased employee efficiency and customer satisfaction. A company can also realize hard savings of up to hundreds of thousands of dollars per year.

Liability Reduction

In addition to providing greater reimbursement accuracy and significant cost savings, FAVR also offers greater compliance capabilities. It eliminates the legal risks of under-reimbursing employees, which can lead to state labor violations or even the threat of class action lawsuits.

Automated Mileage Tracking

With the right vendor, a FAVR program uses an app that captures business mileage automatically. This allows employees to seamlessly track and submit their mileage. Employees get time back in their day and employers receive IRS-compliant mileage logs.

Beginning the Transition from Car Allowance to FAVR

Given the substantial benefits FAVR can provide both companies and their employees, it rarely makes sense not to implement this reimbursement model. However, like most corporate decisions, the key to successful and long-lasting change is good communication. Companies need to take the time to explain the value of FAVR programs to their mobile workers and clearly outline their reasons for switching. Below are three key talking points companies should highlight in preparation for transitioning to a FAVR program:

1. Reimbursements Aren’t Perks

Starting the conversation without a toe-hold can be challenging. What’s the most effective way to start the conversation about transitioning vehicle programs? Explain to employees that vehicle-related expenses are no different than any other category of T&E (Travel & Expenses).

It’s important that everyone in the company – employees and executive-level management – understand that reimbursements are reimbursements, not perks. If an employee paid $20 for a meal, they wouldn’t expect to be reimbursed $50. Take the time to ensure that everyone agrees and understands that car allowance is not added compensation. Emphasize that a reimbursement for business driving is not a perk.

2. Everybody Will Benefit

Notifying employees about transitioning to a FAVR program can be an easy conversation. Since employees are already utilizing their own car, the conversation should focus more on explaining how a FAVR reimbursement works. The benefits are very clear for both employees and the company. Explain that, by eliminating tax waste, a FAVR program allows the company to outlay less money while also making mobile employees’ take-home pay amounts tax-free.

Highlight what’s included in the reimbursement and how it may adjust month to month. For example, when gas prices increase, their reimbursement will be higher. FAVR also considers the fixed and variable costs of operating a vehicle and includes that in the reimbursement.

Companies can leverage those resulting savings to reimburse mobile workers at higher net take-home amounts, while still saving money. Reinforce that FAVR programs are truly a win-win situation for both employees and the company.

3. Mileage Logging Matters

It’s important to communicate the following to employees:

- Capturing mileage in a FAVR program is important.

- Compliant mileage logs are important.

There may be some initial pushback to mileage capture. Especially if employees may not be accustomed to logging miles. Or, perhaps they’re used to recording their mileage by hand, on paper. Explain that this outdated method of mileage tracking is too time-consuming. Additionally, it almost always leads to mistakes and inaccuracies.

Discuss how mileage logs are one of the most important tools mobile workforce managers can use to fairly capture, reimburse and report on employees’ business driving. Also, when used effectively, mileage logs can offer a clear picture of personal and business usage that’s both fair and accurate in the event of an audit.

The bottom line is, it’s essential to automatically capture employee mileage in order to ensure fair reimbursements, maximize tax-free reimbursements and remain compliant with the IRS.

Making the Transition

For companies that choose to transition from a flat car allowance model to a FAVR program, significant cost savings can be realized – not to mention greater reimbursement accuracy.

Making the transition doesn’t need to negatively impact employees, either, or lead to a larger cultural shift in the company. Before making the transition to a FAVR program, however, it is important to take the time to explain its benefits and outline why and how your company will implement this new reimbursement model.

The right vehicle program vendor can help you outline an implementation plan, assist with communication and explaining the program to your employees.

Once everyone in the company fully understands that FAVR programs allow mobile employees to receive an accurate mileage reimbursement while also eliminating the FICA tax burdens to the company and the individual, the only question remaining will be, “Why didn’t we transition to FAVR sooner?”