What are your biggest concerns with your vehicle program? For most companies, its visibility into mileage expense and employee satisfaction with the vehicle program. But another point of concern is compliance. Vehicle programs can be out of compliance in a number of ways: violating labor laws, failing to meet IRS regulations and more. One of the largest points of concern is specifically driver compliance. In this post we’ll walk through the multiple ways a driving employee can be out of compliance and what companies can do to correct the issue.

Driver Compliance

It might surprise you to find how many ways driving employees can be found out of compliance. Driver compliance should always be a priority, but following all the ways they might not meet certain standards can be dizzying. Here are three of the major ways driving employees can be found out of compliance:

- Mileage Capture

- Insurance and Driving Record

- Vehicle Condition

Mileage Capture

As you may know, mileage capture is an essential component of most, but not all vehicle programs. Mileage reimbursement and fixed and variable rate reimbursement programs both require mileage logs. To meet IRS compliance standards, each mileage log must include business mileage, date, start and end locations and business purpose. Employees driving fleet vehicles should also be tracking their mileage, just for different reasons.

Mileage Reimbursement

Employees reimbursed for driving their personal vehicle at a cents-per-mile rate have to submit mileage logs to receive payment. If those mileage logs do not meet IRS compliance standards, employees will have to resubmit with the appropriate information. Non-compliant mileage logs put both the driving employee and the company at risk of IRS audit.

Accountable Allowance

A typical car allowance does not require mileage logs. However, if a company is looking to cut down on tax waste, they may implement an accountable allowance. In this vehicle program, driving employees also submit mileage logs. The repercussions of not submitting mileage logs or submitting ones that don’t meet IRS compliance standards aren’t as high as an IRS audit. The car allowance will simply be taxed, resulting in a smaller reimbursement, one that also costs the company more.

Fixed and Variable Rate

The FAVR program is also dependent on IRS-compliant mileage logs. Much like the mileage reimbursement program, employees will not receive their payment without logs. And, if those mileage logs do not meet IRS compliance standards, employer and employee may be exposed to audit.

Company-Provided Vehicle

This program is a bit of an outlier. The IRS views personal use of a fleet vehicle as a taxable benefit. That means miles won’t need to be tracked while the employee is driving for business. Only when they’re driving personally should they record their mileage. At the end of the day, they owe the company for the personal miles they put on business vehicles. Some companies set up a personal-use chargeback, but these are loosely enforced. In the event of an audit, only IRS compliant mileage logs will stand up to scrutiny.

Solution to Mileage Log Compliance

Before we talk about the solution, let’s talk about the challenge. Why is tracking mileage so difficult? To many, it may just be an unfamiliar process. That, or they have difficulty finding the materials to manually capture the right information. The best solution is to remove the friction point of mileage capture. That’s why so many companies choose automated mileage capture.

The right vehicle program vendor can enable mobile workers to capture their mileage effortlessly and submit it anywhere in IRS compliant mileage logs. No more manual processes on the road, no more missing essential information. Driver compliance issues with mileage capture become a thing of the past.

Insurance and Driving Record

When a company hires an employee for a driving role, the interview process should include some kind of screening. Unfortunately, this isn’t always the case. According to our most recent benchmark report, as many as 22% of companies don’t check motor vehicle records at any time. Companies assume considerable risk when they don’t check driver compliance.

Solution to Driving Record and Insurance Compliance

While a mobile worker’s driving record and their auto insurance are not the same thing, the issues with both of these can be solved with one solution: a comprehensive driver safety program.

With the right vendor, insurance verification is mandatory. Much like mileage logs, employees will not receive their reimbursements unless they’ve submitted proof of auto insurance. This is for the safety of the company, the company’s mobile workers and everyone else on the road.

Checking a potential employee’s driving record should be an essential part of the hiring process. Companies do this by running a motor vehicle record (MVR) check. These can help employers determine if a candidate is the right fit for a driving role. But MVR checks can also help companies mitigate risk beyond the initial hire. Continuous MVRs will inform employers when a driving employee commits an infraction. This can help companies catch bad behavior before it becomes a trend.

Vehicle Compliance

Driver compliance is tied closely to the vehicle they drive. There are many ways a vehicle can be out of compliance. For some vehicle programs, a certain car may be too old to be supported. For companies pursuing greenhouse gas (GHG) goals, certain vehicles may have too big of an emissions footprint. Vehicle compliance is dependent on the company’s priorities and their vehicle program.

Vehicle Compliance Solutions

Tackling vehicle compliance can be tricky. Even with a fleet of vehicles, where a company has full control over their vehicles, making the change requires thorough consideration. For companies that reimburse employees for the business use of their personal vehicle, that change can be more challenging.

Whether the vehicle doesn’t fit the program or its emission levels are too high, the best approach here is incentive. With the right vendor, employers can ensure that employees who shift to compliant vehicles receive higher reimbursements to help with payments, or work to help them through other options.

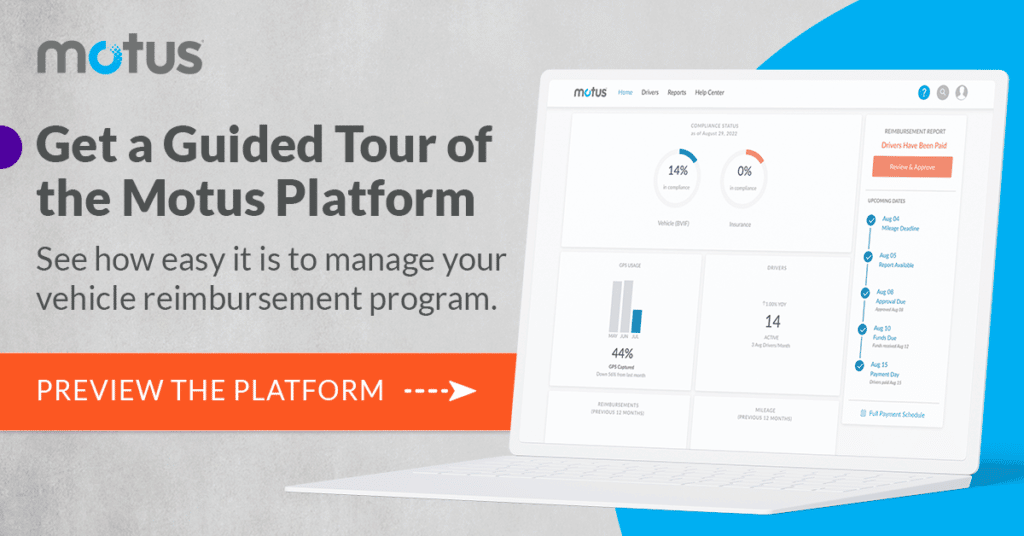

The Importance of Driver Compliance

Driving employees are an essential piece of any company. When a mobile worker, or their vehicle, is out of compliance, it can put the company in jeopardy. Vehicle programs tend to take a back seat in the grand scheme of company priorities, but ensuring driver compliance is vital. The solution to most compliance issues can be tied to the vehicle program provider. With the right vendor, compliance issues become a thing of the past. Ready to learn more about choosing the right vendor?